Why Should I Invest My Money When The World As We Know It Is SURELY Ending Soon?

Why does compound interest matter in the post-apocalyptic wasteland?

Key takeaways:

Bet on the future – If the world doesn’t end, you’ll wish you invested.

Let money make money – Compound interest does the heavy lifting over time.

Just start – Automate, invest, and don’t overthink it.

You might be thinking, “Why is this bitch on her high horse telling me to save money when I’m pretty sure I’m going to die by 50 and/or the government is going to fuck us all?” I totally understand where this is coming from. When things are feeling overwhelming and chaotic, it’s easy to throw up your hands and say, “None of this matters! What’s the fucking point?” I’ve heard many different versions of this from clients, friends, and strangers. Most recently, I was at Trader Joe’s when the checkout person picked a fight with me about capitalism.

It happened because I was wearing my fabulous Roth IRA / Black Flag shirt (which, side note, is an excellent conversation starter at parties and grocery stores). Their argument? Inflation is so high. Rent is impossible. Unchecked capitalism has wrecked so many lives. So why even bother trying?

But here’s why:

I can’t fully describe the feeling, but saving and investing money feels good. Watching a plant grow from just a seed is pretty frikkin’ miraculous. The same goes for watching your little investment account grow with just a $100 a month contribution. It’s pretty awesome.

What if it all works out? What if you have a long happy life? What if you changed your mindset and became a glass half full kinda person?

Now I have a lot of empathy for this person and where they’re coming from. But, I advised them to think differently. What if these fears about the economy and the government aren’t true. Sure, it could be true. But what if it wasn’t?

What if fortunes changed?

I know that can feel hard to imagine right now, especially if you’re living paycheck to paycheck. You probably have a negative association with money: your bank account is always going down. It’s a stressful, soul-crushing thing. Money is always disappearing, always being spent on things you need just to survive. Or maybe you’re making more money than you ever have but still just never seem to have enough. You’ve got lifestyle inflation, big time.

But would it be so crazy if you flipped the script? What if you acted like you’re going towards a better future, even if it seems unlikely?

This is essentially the “latte debate.” You know, when pedantic personal finance writers tell you to skip the latte and use that money to invest instead. I’m sorry to say, that’s not bad advice. Converting a habit where money leaves your account into one where money enters your account and grows is what we’re trying to do here. So if you’re in the “struggle” phase, I’m sorry to say it, but your $7 latte habit is what’s between you and a having a fully-funded emergency fund in two years.

Here’s the math: If you buy lattes 5 days a week at $7 a cup, after a year you will have spent $1,820. If you instead saved that latte money for three years in a “high-yield” savings account paying a 4% interest rate, then you’d save almost $6,000 after 3 years. Is that going to change your life and be a down-payment on a home, NO. But it’s going to be the shield you might need to turn your financial life around1.

If the world doesn’t end, you better f*cking understand compound interest

Now maybe all that math was confusing, but I don’t just need you to understand compound interest. I need you to live it. Later in this newsletter I’ll come back to compound interest to more fully break down how it works. I’m going to show you some charts and graphs. I’m going to tell you a story about bunnies fucking to help get the point across. But here’s the truth: The only way to truly understand and believe in compound interest is to invest your money (I don’t care how you got it) in a diversified portfolio in the stock market and watch it grow.

If that sentence made sense to you, congrats—you can skip down to the next section. If that sentence scared the shit out of you, you clammed up, and got embarrassed because you actually have no idea what I’m talking about and wondered, “What the hell is a diversified portfolio!?”…HI, let’s hang out. I’m going to help you take your head out of the sand.

First off: don’t feel ashamed or worried if you have no idea what a diversified portfolio is. I was in your shoes not long ago. I was once a journalist writing about esoteric pop music for a music website who didn’t know her Roth IRA from her asshole.

But eventually, I learned more about personal finance and I ended up starting a podcast almost ten years ago called Moneysplained to answer these basic and fundamental questions about money. So I GET IT. You’re smart, you understand what these words mean, but maybe you actually have no idea how to start investing.

So first, let’s demystify what investing is.

But When You Say Investing, What Do You Mean Exactly?

First, you need to know what a portfolio is. A portfolio is an account that’s held at a financial institution that you can invest your money in. That money is then allocated with a lot of other people’s money in a larger pot in a variety of stocks and/or bonds. (Investing in a stock means that you’ve bought a part of a company, whereas investing in a bond means that you’re loaning your money to a company and earning interest on it until it’s paid back.) A portfolio can own thousands of different stocks of different companies. Most people these days don’t own individual stocks because that’s pretty risky and with the trading technology we have, unnecessary. So nowadays, most people own funds which are allocated to thousands of stocks. For example, you could own only one single fund your entire life and be in a pretty good spot because you stayed invested for a long time and your money is diversified. By buying just one fund, you could own every single stock listed on the New York Stock Exchange and the NASDAQ. So it’s never been easier to invest as a regular person and I love that for you. But are you actually going to do it? Are you actually going to open an investment account and get started?

Below, I’ll give you some advice on how exactly you can start investing your money, how much to invest, and what to invest in. But before I get into that, let’s dig in a little deeper into the question at the top of this newsletter: Why should you invest your money when it feels like the world is ending soon?

Investing During Uncertainty

Why am I advising you to invest your money now, when our government feels unstable and the world feels like it’s in disarray? I get it, it’s a wild political time right now. The tectonic plates that we rely on for government services appear to be cracking and shifting. Let me level with you: I don’t like what’s going on but I know deep down because I’ve studied the markets that this will most likely pass.

The most likely outcome of this period of government agency dismantling and turmoil is that there is a correction and we swing back the other direction. I can’t guarantee it, but that’s usually what happens. Usually, we don’t fall into a global recession that starts World War III and renders the midwest an apocalyptic wasteland after the nukes drop. Usually, what happens after political or economic turmoil, is that the stock market (and the economy, aka your ability to earn a living wage to buy things that make you comfortable) recovers.

This chart changed my life. And if you haven’t seen it, I hope it changes yours. It gave me something I never had before I started learning about the intricacies of the stock market: perspective. The first time I saw it was on Barry Ritholtz’s blog back in 2017. Here’s an updated version from Morningstar to bring us into the present.

What do you see? I see that a dollar invested continues to grow and that when bad things happen like war and pandemics, the market might falter but it always bounces back. And that while you may see the value of your investments drop, if you wait a few years, they have ALWAYS bounced back. That’s why you need to keep investing and let that compound interest work in your favor over time.

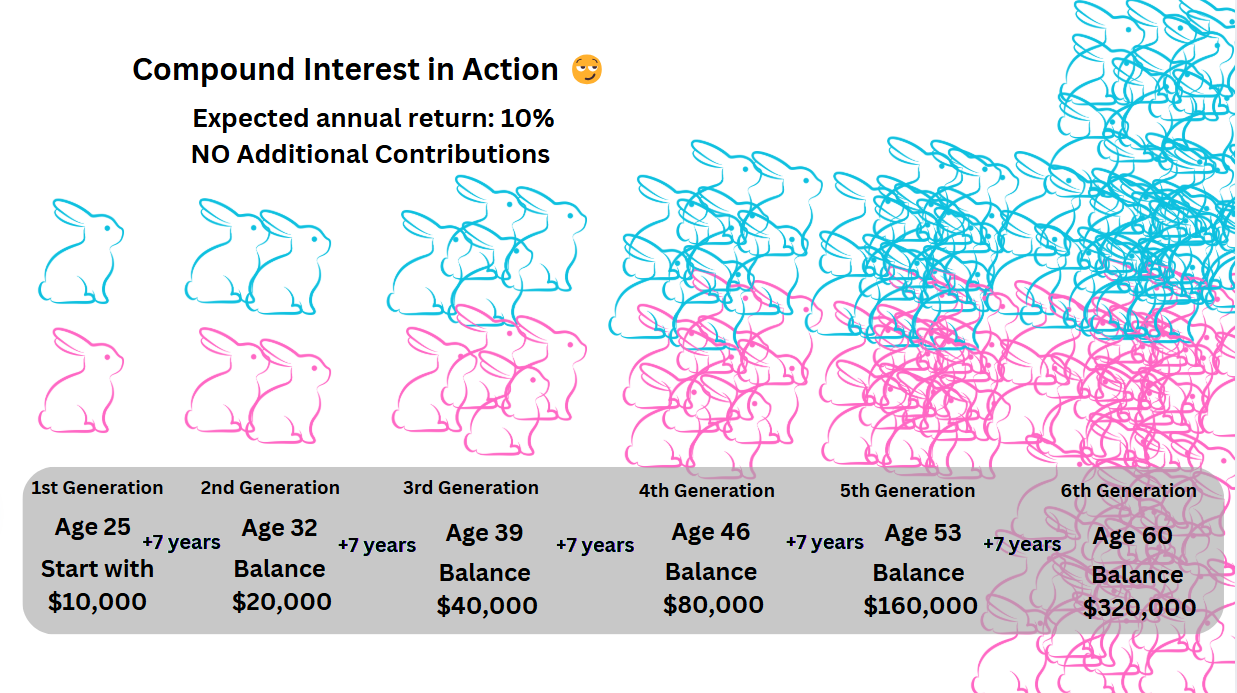

Fucking Like Rabbits: The Miracle of Compound Interest

Alright, let’s talk about bunny sex.

You know how rabbits reproduce at an absolutely unhinged rate? You start with two, and in no time, you’ve got 200.

That’s how compound interest works—except instead of feeding and housing an army of tiny creatures, your money is just out there multiplying quietly in the dark. And you don’t have to do anything. That’s right, no need to complicate things, no mopping floors after gross AirBnb guests, just literally sit back and watch your money compound on itself. Big asterisk: the market doesn’t always look like it’s going up, but historically, over periods longer than 5 years, it almost always does. So we get this really great piece of investment advice as a rule of thumb which is: set it and forget it. Put money in the market, diversified across many different companies and watch it grow.

Here’s the deal: When you invest, you’re not just making money on what you put in. You’re making money on your money’s money (or in other words, the interest your money earned while it was just sitting there). And then money on that money’s money. It’s a beautiful, unstoppable cycle—like bunnies, but less chaotic.

Would you like to turn $1,000 into $5 million dollars? It’s going to take some time, but it’s easier than you think. Let’s look at how the math works if the bunnies didn’t do it for you.

In this hypothetical scenario let’s say:

We start with $1,000 in an investment account at age 25

Every month we automatically invest $300 into that account ($3,600 per year) for 50 years

Our portfolio earns an average return over these 50 years of 10% annually2

Let’s look at what happens to that $1,000 dollars after 50 years of adding $3600 a year into the account. (By the way, if you’re just learning about this stuff, check out the free calculators at Vertex. I’ve used them for years to play around with loans and various retirement calculations. Totally free and easy to download to Excel and convert to a Google sheet.)

Ta-da! Your money’s turned into over $5 million! And look at that! In the 50th year, your investment is kicking off half a million dollars of income for you! But there’s a catch here, you have to start early! If we take the same scenario but only invest for 30 years instead of 50, we never get to that wild period of compounding where your portfolio is printing money (6th generation in the bunny image above).

If we only invest for 30 years (let’s say we start at 45 instead of 25), we don’t end up with $5,000,000, we end up with $674,147. All I did was change the Years of Growth from 50 to 30.

If I’ve made you sad or depressed, I’m sorry, that was not my intention. You can still catch up if you’re not 25. There’s a cheat code to getting to a big number like $5 million if you’re starting a little bit later. Here’s how we can get to $2.3 million if we start with $10,000 and contribute $1,000 a month for thirty years. While these numbers may seem completely abstract, what you’re basically looking at here is your 401(k) with a $12,000 annual contribution amount.

And if you DON’T invest, your hard earned money will simply waste away. The termites of inflation will chew right through your savings. If you leave your money in cash or something you have decided is “safe,” your money will not grow fast enough. I re-ran the numbers here with an interest rate of 3% instead of 10% and look what happens: we get only $599,917 after 30 years, even with active contributions.

The Hardest Part: Actually Doing It

Now, if you’re like most people, you’re nodding along but haven’t actually opened an investment account yet.

And I get it. Thinking about money is stressful. Opening a brokerage account feels intimidating. You’d rather watch another episode of Love Is Blind than figure out what an index fund is.

Future You will be out here, wanting to quit your miserable job at 50, but unable to, because 35-Year-Old You decided investing was “too confusing.”

So, let’s make it stupid easy:

Pick a platform – Betterment, Wealthfront, Fidelity, Vanguard. Doesn’t matter. Just pick one.

Automate it – Set up a recurring transfer from your bank account to this investment account, even if it’s just $50 a month. Your future self will thank you.

Invest it – Don’t forget this step! I can’t tell you how many times I’ve seen investment accounts where the money is still just sitting in cash because someone forgot to buy a fund. You have three options.

Select and manage the funds yourself (DIY)

Have an algorithm help you (Robo Advisor)

Hire a professional (Financial Advisor)

Leave it alone – The stock market will go up, it will go down. Do not panic. Do not sell when things look bad. Just keep adding money and let the bunnies do their thing.

When it gets big, get help – Watching your money grow is an amazing thing. But once the pile of money is big, like downpayment on an NYC condo big (say $250,000), you’re going to want to get some professional help. Why? To optimize your returns, pay less tax, and protect you from your own emotions.

What If the World Does End?

Now, I hear you: “But what if society collapses? What if my Roth IRA becomes worthless because we’re all bartering for beans in the ruins of capitalism?”

Fair point. But in that case, you’re gonna have bigger problems than whether you invested. I fully support you building a bunker. I fully support you learning how to shoot a rifle. Prep away.

And if we somehow don’t descend into total chaos, wouldn’t it be nice to have a fat stack of money waiting for you?

Your options are:

Bet on the world ending and live paycheck to paycheck forever

Bet on things maybe working out and give yourself a shot at financial security

Personally, I like option two. Because if I’m wrong, at least I’ll have enough money to afford the good Rancho Gordo beans.

Go invest. If you don’t know how, ask for help. Give yourself a deadline and report back to me.

Parting shot: Betting on the end of the world is a one-time win. Betting on the future pays dividends.

Best $20 I spent this week: A used copy of The Worst-Case Scenario Survival Handbook—because while I’m 95% sure we won’t be bartering for beans in a post-apocalyptic hellscape, I’d still like to know how to wrestle an alligator. Just in case.

See last week’s post on the different modes of saving.

Depending on which period you’re looking at and what you’re invested in, a diversified portfolio can have a wide range of returns - think like 5% to 20%.

This is, hands down, the best article on compound interest I have ever read. If there is a nuclear fallout, I hope this, Cher, and cockroaches are what's left to rebuild.

Also, where's the Roth IRA merch store?!

This post FINALLY made me want to take the leap again and open up a brokerage account during my lunch break today. I literally have Vanguard open in another tab. The only issue is I realized (AKA Googled) that since my husband works for a major bank, I probably have to ask him to check with their compliance team to see if there are any restrictions/if we have to use a certain brokerage. Am I correct in this, or did Google just make something up?