Overnight money solves your problems; slow money teaches you how to solve them yourself.

Key Takeaways

Without the gradual process of earning and managing wealth, you may not be able to handle the responsibility of accumulating a lot of wealth quickly.

Building wealth slowly can make you happier, give you more satisfaction and can make you feel rich enough while also owning your own sense of freedom.

Waiting for someone else or something to make you rich is not a life well lived.

Wealth is a funny thing. Those who have it, seem to enjoy it but aren’t always happy. Those who don’t have it, usually want it desperately. And those who have a little bit of it seem generally, for the most part, content. Unfortunately, the means by which we acquire wealth often has a direct outcome on how we feel about all the money we’ve accumulated.

We hear that lottery winners often end up worse off than before they bought the ticket. I’d like to think that we only hear the bad stories and that there are hundreds of lottery winners living in private bliss. But based on my work with clients who suddenly find themselves very rich overnight, it takes a lot of emotional (and spiritual) work to come to terms with your new reality. Without proper mental preparation, it’s easy to lose yourself. Consider the cautionary tale of William "Bud" Post III. In 1988, Bud won a $16.2 million Pennsylvania Lottery jackpot. Sounds like a dream, right? Yet, within a year, his brother attempted to have him killed for the inheritance, an ex-girlfriend successfully sued him for a portion of the winnings, and Bud found himself $1 million in debt. He later admitted, "I was much happier when I was broke."

It's not just lottery winners who grapple with the dark side of wealth. Children born into affluent families, often beneficiaries of substantial trust funds, face their own set of challenges1. Challenges like being named Bartholomew or Buffy. While they might not worry about paying rent, they often struggle with identity, purpose, and mental health issues.

Psychologist Madeline Levine, in her book The Price of Privilege, notes that teenagers from affluent families experience higher rates of depression, anxiety, and substance abuse than their less affluent peers. The pressure to achieve and the emotional distance from often overworked parents contribute significantly to these issues. A widely cited study found that children of high-income families are at a higher risk for substance use, anxiety, and depression. The study suggests that pressures to achieve and isolation from parents are significant contributing factors. Anecdotally, you probably know a rich kid or two who lost their way.

Anyways, getting rich without trying too hard through winning the lottery, marrying someone who appears to have a lot of money, or inheriting wealth can appear to be the path of least resistance. But if you didn’t get it yourself, you’ll always be looking over your shoulder.

So, why does sudden wealth often lead to such turmoil? The answer lies in the rapid lifestyle changes and the psychological unpreparedness of individuals who come into large sums of money unexpectedly. Without the gradual process of earning and managing wealth, many find themselves ill-equipped to handle the responsibilities and pressures that come with it. A lot of what my financial advisory firm does for clients is act as a sort of pseudo-therapist to help clients through a dramatic change in net worth.

There’s a great idea called the "hedonic treadmill," which suggests that people quickly return to a relatively stable level of happiness despite major positive or negative events. In the case of sudden wealth, the initial euphoria can fade, leaving individuals feeling as they did before—or worse, due to new complications.

So given all this information, you might wonder what is the best way to get rich and remain relatively happy and fulfilled? Let me break it down for you. I present…

The Top 7 Ways to Get Rich, Ranked

I start with #7, being the worst way to get rich and build up to #1, the best way. (I just want to acknowledge that there are many other ways to get rich (like being a supremely talented actor or athlete or getting lucky on a crypto bet that I didn’t include in this list because I didn’t think they were interesting enough to write about.)

#7 Win the lottery

#6 Inherit enough money to dramatically change your life

#5 Marry someone with a lot of money

#4 Work for a company that has a liquidity event

#3 Become an influencer or creator who builds a personal brand

#2 Start a business

#1 Invest a percentage of modest income over a lifetime

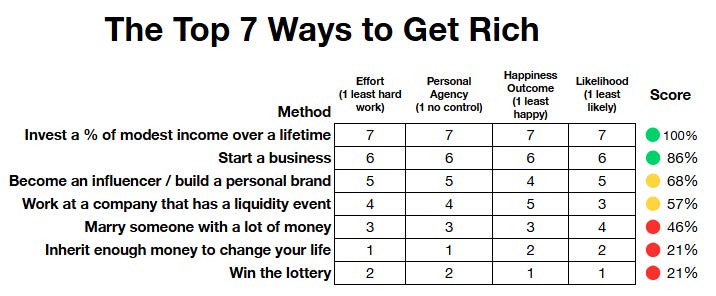

Below is a chart that shows how I ended up with this ranking order. However, I will not entertain any criticism of my methodology here. I am for one, terrible at statistics, and two, don’t care what you think, this is my newsletter and I can do what I want. I’m presenting this information in a way that serves me best to make a point.

Let me begin with biases. I run a highly successful service business and am therefore biased. I believe that this is the superior way to make money in America. It’s not that hard to get good at something you can provide as a service to others. Some require talent and skill, but many do not. Fundamentally, some business acumen and not being an idiot is required. Entrepreneur magazine recently published a list of 87 service businesses you can start today so perhaps that will serve as some inspiration to you.

How I Scored This (Let’s Call It “The Richter Scale”)

This isn’t peer-reviewed science, but it is based on vibes, judgment, and an unhealthy amount of overthinking. I ranked each path to wealth across four categories:

Effort – How much actual work, time, or soul you have to put into this. A 1 means it just happened to you.

Personal Agency – How much control you have over the outcome. Can you actually influence this, or is it in the hands of a Powerball machine, probate court, or someone else’s emotional availability and shitty personality?

Happiness Outcome – How likely you are to be not just rich, but glad you got there. Money doesn’t guarantee joy, but some paths have a better track record than others. (Spoiler: slow and steady usually wins.)

Likelihood – How likely is this to actually happen for a normal person?

Each method gets a score from 1 to 7 in all four categories, and I added them up for a totally objective final number.

#7 Win the lottery

This is the worst way to get rich. It’s also the least likely. As discussed above, winning the lottery is a very dramatic and jarring experience that most humans are not prepared for. It ranks lower than the inheriting money category of happiness because at least if you’re born into money, you’re surrounded by people like you. You likely have family and friends with whom you can commiserate. If you’re a gas station attendant making $22,000 a year, chances are you won’t have too many pals who will sympathize with you should you find yourself with millions. You’ll likely be alienated and not trust your friends and family anymore - how will you be able to know which relationships are genuine and which ones are just based on getting a chunk of your winnings?

#6 Inherit enough money to dramatically change your life

I’m too lazy to try and figure out how likely this is, but let’s assume it’s not very likely. Plus, you have no control over the circumstances you’re born into. Obviously there are different levels of wealth you can be born into. Being born into money means you’re poisoned from day one, unless you have parents who work very hard to instill good values that actually make you a good person. Inheriting money later in life is nicer, I think. You’ve had time to work hard and develop on your own. You know what you stand for, and you hopefully have a good sense of self. As part of this study, I’ve determined that the optimal age to inherit wealth is 36. This is directly correlated to the fact that I am 36 years old. I’ve figured my shit out, I know who I am, I’ve surrounded myself with good people, I think I’m generally a net positive to society, and now would be a really great time for someone to drop a few million dollars in my lap.

#5 Marry someone with a lot of money

Ah yes, the old gold digger stereotype. Let’s dispense with that and remember it’s no longer a gendered issue. Divorce lawyers have noticed an uptick in more women paying child support and alimony2. I have one point to make, and it’s a simple one: don’t marry for money, marry for values around money. Just because someone appears wealthy, doesn’t mean they have access to money. And that means that you likely won’t get to spend it. And if you do, there will certainly be strings attached. I wrote 4,000 words about this. I’m not saying don’t ignore someone’s economic status in your calculus of finding a life partner, but money is so complex that what you see is never what you get.

#4 Work for a company that has a liquidity event

This is where I actually know what the fuck I’m talking about. I run a financial advisory firm that has helped more than 300 families through a liquidity event of some kind. This usually means they are an employee at a company and are issued either stock options or stock shares of that company while it’s still private. Then, that company goes public, and when the shares start trading on the open market, they find themselves with real wealth.

In theory, this is one of the more dignified “get rich kind of fast” options. You did the work. You bet on something. You even paid taxes. But let’s be honest—it’s a gamble. You have some agency, but it’s still dependent on a bunch of venture bros making decisions you don’t understand, and market conditions you can’t control. You can do everything right and still walk away with shares worth less than the mug you stole from the office kitchen.

Bonus points if you worked for a unicorn and stuck around just long enough for the exit, minus points if your company IPO’d at $42 and now trades at $3.14.

#3 Become an influencer or creator who builds a personal brand

This is the most cursed way to get rich while still earning it. Although I think some influencers are able to get to the top and gracefully exit. Becoming an influencer ranks higher than marrying rich because at least you’re marrying the algorithm instead of a human being, which arguably has less emotional baggage. You can make a lot of money doing this—and some do—but it comes at a cost. You’re monetizing your personality. You are the brand. Your entire existence becomes a pitch deck, and even your grocery haul is content.

It’s not all ring lights and brand deals. The burnout rate is high. The algorithm is fickle. You might lose your sense of self somewhere between #spon posts for protein powder and 90-second reels about your skincare routine. But, to be fair, if you’re talented, relentless, and willing to live your life publicly, there is real earning potential here. Just don’t be surprised when your fans turn on you for not being relatable anymore once you buy a house with a pool.

#2 Start a business

I love being a business owner. It’s hard, but it’s incredibly rewarding. Starting a service business was perhaps the second-best life choice I made (marrying my dope husband was probably the first). Start small, stay lean, and solve a real problem. You don’t have to raise money, you just have to have the ability to not flake on people and to send invoices on time. Starting a business is one of the most empowering and rewarding ways to build wealth—not just because of the financial upside, but because of what it teaches you about yourself.

But make no mistake: it’s not easy. You’ll cry. You’ll Google things like “how to fire someone nicely” and “what is quarterly tax?” You’ll fantasize about throwing it all away and getting a simple job you can clock in and out of. But when it works? It works. You build equity, reputation, confidence—and potentially a really profitable exit. Or just a solid, sustainable income stream that grows with you. Growth is great. Who doesn’t want to grow?

#1 Invest a percentage of modest income over a lifetime

This is the least exciting, yet most effective path to wealth. I wrote about it extensively last week. Sorry, here’s another link and 4,000 words you have to read:

This method is about time, discipline, and patience—three things our culture does not typically reward.

This is the “dad in a Costco polo who retired with $2 million” strategy. He never had a big title. He just lived below his means, saved 20% of his income each year into a simple stock and bond portfolio, and let compound interest work its magic. Boring? Yes. But here’s the kicker—this path leads to the highest levels of long-term happiness, because you earned every dollar and you know how to manage it. And even better, you enjoyed life ALONG the way. You hit life stages without turbulence. You weren’t handed a lump sum you didn’t know what to do with. You weren’t beholden to a partner, an algorithm, or an IPO. You just lived your life, saved diligently, and kept your cool when the market dipped.

If I could make this sexy, I would. But in a world addicted to speed and attention, the real flex is slow, quiet confidence.

In Conclusion (Or: What’s the Point of All This?)

First of all, Happy April 1st :) Money isn’t just about what you have—it’s about how you got it. The method matters. Fast money can solve some problems, but it often creates new ones. Slow money? That builds not just wealth, but wisdom, boundaries, and a much healthier relationship with your bank account (and yourself).

You can build something—quietly, steadily, intentionally—that makes you rich enough to feel free. And that’s the whole point, isn’t it?

Parting shot: Marry compound interest, not Bartholomew Astor Caldwell III.

The best $20 I spent this week: Okay, this was more than $20, but how cool are these NFC tag nails? I spent $64 on these.

Rich people who rich right on Instagram is fun.

Here’s the study cited in Marketwatch.

My grandpa started a business (#2), sold it (#4) and set aside a modest amount to allocate as inheritance. I received funds at 25 and 30 (#6) - great ages! - and it wasn’t a life changing amount (but it probably could have bought a house in the 80s/90s!) but it was great to generally just invest and work towards #1, maybe even #2, thinking about the lessons he’s passed down. I would love to continue that legacy.

You missed option 8: all of the above. I’m going for all of them but I believe my ship has sailed on marrying rich and inheritance