Welcome to the first edition of “Am I Saving Enough?”—the column where all you voyeuristic creeps can get your rocks off ogling someone else’s balance sheet. I say that with love.

Here, I dive into real-life financial scenarios to answer one of life’s most nagging questions: Are we on track? Each installment features a peek under the hood of someone’s finances—anonymous, of course—with a mix of analysis and practical advice. Think of it as a balance-sheet makeover meets therapy session, designed to help people navigate their money goals in front of an audience (and hopefully, the audience picks up a few things along the way). This column is about progress, not perfection.

A quick note: My opinions are my own and should not be considered financial advice. Money Changes Everything is for educational purposes only.

If you’d like to have your savings habits examined, send me a direct message through Substack.

One final bit of housekeeping before we get into it: This Friday, January 31st, at 2:30 pm ET, I'll be joined by Lindsey Stanberry of

in the Substack app for a live video conversation where we will discuss how women can prepare for the Great Wealth transfer and ensure that their spending and investing align with their values.This is part of the Substack Market Forecast Summit, which is bringing together finance and business figures, writers, and commentators for a daylong virtual event on Friday, January 31, directly within the Substack app. The virtual summit will explore the trends, challenges, and opportunities that may shape the year ahead through back-to-back live videos throughout the day. You can see the full schedule here, and if you’re unsure how live video works, check out the FAQs at the bottom of the page.

You’ll need to download the Substack app to join our conversation.

Am I Saving Enough? #1: Newlyweds with No 401(k) Access

I received an email with the subject line: "My sad 401(k)." It was from Mike, the new-ish husband of one of my closest friends, Beverly.

I had asked Beverly and Mike if they’d volunteer to be my first victims in a new feature I was noodling on.

“Victims of what exactly?” Beverly asked over text. Fair question. At the time, I wasn’t really sure. I had this idea about doing “balance sheet teardowns,” where I’d analyze someone’s finances, roast them (gently), and toss out suggestions in a game-show-style format. After some thought, I decided this was maybe a terrible idea.

But Beverly, ever the overachiever, sent me their balance sheet anyway. Within a day, I had a full breakdown of their assets, income, expenses, retirement accounts, and liquid savings. Almost every box was filled out—except Mike’s 401(k). Instead, there was a note: “?????? - I think like 30K it’s not a lot as he started it p late.” Beverly, that was pretty bitchy—come on.

I could feel the tension leaping off the spreadsheet. Beverly, who is meticulous about her finances, had clearly tried to make sense of the situation and was a little salty about Mike’s slower start on retirement savings. Coming from a place of love, Beverly was trying desperately to take stock of their situation and was upset that her partner hadn’t been as diligent about retirement savings as she had.

Getting Mike’s 401(k) information was slightly harder, and I knew immediately why. Well, first of all, that comment from Beverly would have sent me running. If you look at the numbers side by side with no context, you can see Beverly has more saved for retirement than Mike—even though she has a lower salary and fewer years of earnings, simply by being a few years younger.

Still, I got Mike’s 401(k) information almost immediately upon requesting it. It wasn’t as fast as Beverly’s timeline, but it was still fast.

Reading between the lines, I sensed stress about money and anxiety about not having enough saved to support their married life together.

I’ve had clients take four months to get us 401(k) statements when we’re trying to provide advice—and they continue paying us while our hands are tied (yes, you know who you are). When you’ve talked to as many people between the ages of 25 and 65 about money as I have, you start to understand very quickly why people don’t want to talk about money. It’s shame.

It’s always shame.

Shame comes in 31 flavors too! Shame that there isn’t more money. Shame that there is debt. Shame that there’s a $2,500 check coming in from Grandpa every month to help with rent.

When we’re talking about money, we have to be extra gentle with the people we love. We have to be saccharine and kind and sit on our judgy hands. It’s taken me years of training to not judge anyone. And if I had a dollar for every client that’s ever said, “This is a judgment-free zone, right?”—I’d be an even richer woman.

So, Mike felt shame that he didn’t have more money saved, and Beverly was urgently trying to find a solution to a problem. Enter: a financial planner.

If Mike and Beverly were clients of my firm, Brooklyn Fi, we would first do an entire goal-setting exercise to understand where everyone is coming from… and where they’re headed. But today, we’re going to jump right into the key question:

“Am I Saving Enough?”

Comparison is the thief of joy1

As humans, we just want to know we’re doing okay. We crave benchmarks.

Ever find yourself glancing at your neighbor's new car or scrolling through a friend’s vacation photos, wondering how you stack up? You’re not alone. This itch to measure ourselves against others is something psychologists call social comparison. Back in 1954, a guy named Leon Festinger came up with the Social Comparison Theory2, which basically says we figure out how we’re doing by looking at others.

But why do we do this? Is it about wanting to be better than everyone else, or just making sure we’re not falling behind? It’s actually a bit of both. Sometimes, we look up to those who seem to have it better—maybe they’re richer, in better shape, or more successful. This "upward comparison" can light a fire under us to improve. On the flip side, "downward comparison" happens when we look at someone worse off, giving ourselves a little ego boost.

The kicker? While these comparisons can push us to do better, they can also mess with our heads. Constantly seeing others' awesome lives play out on social media can lead to feelings of inadequacy or envy. It’s a double-edged sword: a bit of comparison can motivate, but too much can drag us down.

So, try not to compare yourself too much here. Remember: everyone’s running their own race. A little self-reflection goes a long way, and focusing on your own progress might just be the key to feeling “okay.”

I guarantee you will feel one of two ways about Beverly and Mike’s balance sheet: either relieved you have more savings than them, or scared that you’re behind.

The numbers

Balance Sheet3

Spending

Income

Are we saving enough?

I have never met two people who make the exact same amount of money and share everything equally. Even if that’s true for some magical couple today, that bizarro equality won’t be the case forever.

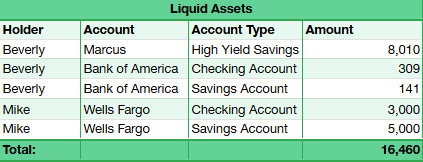

Looking at Beverly and Mike’s balance sheet, there’s a lot that’s going right, but of course, there’s room for improvement.

My first piece of advice? Get rid of the cat. JUST KIDDING. Although their cat is sort of terrifying and I’m kind of afraid of it. Beautiful, but terrifying.

I have seen clients spend more than 10% of their net income on pets. If that makes you happy, go for it. I spend a shitload of money on golf outfits and fitness, so I will never judge you for spending money on something that makes you happy.

The 50/30/20 rule

There’s a popular budgeting theory that’s so simple, and I think it makes a lot of sense. It’s called the 50/30/20 rule, first conceived by my favorite U.S. senator, Elizabeth Warren. In her previous career as a Harvard law professor, she wrote an excellent personal finance book, All Your Worth, in which she explained this theory. She called it the “Balanced Money Formula,” and it goes like this:

50% of your income goes to Must-Haves (rent, utilities, minimum debt payments, etc.)

30% goes to Wants (dining out, groceries, shopping, and vacations)

20% goes to Savings (retirement, emergency funds, etc.)

Pretty straightforward, right?

As I started analyzing Beverly and Mike’s numbers, it quickly became clear to me that they are well below the 50% allocation for Must-Haves. Reader, I sighed a big ol’ financial planner sigh of relief when I saw that. When I encounter a client spending 50% or more of their income on needs, we have a long road ahead of us. Having a conversation with someone about moving to a smaller apartment or downsizing is a lot harder than gently suggesting we cut down the “Want” spending by 8% to make room for more savings.

This isn’t a perfect formula for everyone, but it’s a great way to gut-check your spending. Beverly and Mike are well below 50% on needs, so we’re off to a solid start.

Let’s not debate whether Spotify or the New York Times is a “need” because they’re so small. Sure, we might be able to squeeze out another $2,000 a year in savings if we cut small joys out of their lives, but that’s not my style. Life isn’t worth living if you can’t binge Seinfeld.

So Beverly and Mike are savvy about their must-have expenses. Said another way: they live within their means already, and we just have a little tweaking to do to get them excited about saving more. What I didn’t get is their actual spending report—what are they spending on dining out, vacations, shopping, groceries, and all the variable expenses that seem to eat away at our ability to save? Are they collecting limited-edition Crocs or subscribing to a caviar-of-the-month club?

Actually, I don’t really care.

I don’t care what they actually spend money on because I’m not going to make them stick to a budget. I’m going to suggest they save first and then spend the rest.

The facts

Beverly’s company matches up to 3% of her 401(k) contribution and then puts an additional 7% on top of that! She’s currently contributing 6% of her total salary, which is about 10% of her take-home pay. WOW! With her company match, she’s saving 16% of her gross income into her 401(k).

Mike’s 401(k) savings rate is 8% of his net income, with no company match.

Mike didn’t have access to a 401(k) until last year.

Beverly receives a gift of roughly $6,000 from her parents every year, which is deposited directly into her Roth IRA.

Are they saving enough?

In short: No. However, their expenses are low enough that, with a little nudge, an increase in 401(k) contributions this year should put them in a good spot to stop working at some point.

My recommendations

Combine and cut healthcare costs

Now that they’re married, it might make sense to get on the same health plan. If Beverly could get on Mike’s plan, they could potentially eliminate her significant medical insurance expense of more than $5,000 a year. I don’t want to assume this is possible—maybe her plan is better, and she needs the low deductible to cover some recurring expenses like therapy or prescriptions. But marriage is a “qualifying life event” and presents an opportunity to join your spouse’s health plan.Get to a 20% savings rate (to retirement accounts)

Saving $100 per paycheck into a savings account at a bank, which Beverly is doing, does not count toward a 20% long-term savings rate. Why? Because you’re likely to spend the money in your savings account on an emergency. While it’s technically savings, it’s just temporary.I recommend that Beverly and Mike aim to get to a 20% savings rate in their 401(k)s. However, they also need to build up more of a temporary cash savings cushion, which I’ll get to in a moment.

Have a solid shared emergency fund

As a recently married couple, it’s time to think about shared goals. I don’t like to tell couples whether to combine or split their finances—it’s such a personal choice. However, I do think that when two people are in a long-term committed relationship, it makes sense to have some shared savings.

They can keep their separate checking accounts. I usually recommend two months of essential expenses in there—about $3,000 for each of them.They can keep their existing personal savings accounts, although Mike should move his savings to a high-yield account like Marcus or Ally Bank. Wells Fargo is certainly not paying the interest it could be earning.

My recommendation for this year (2025) is to aim for three months of essential expenses saved in a joint high-yield savings account. That’s about $9,000 total, so I’d suggest they each contribute $4,500 and be done with it.I’d ideally like them to have six months of living expenses saved eventually, but it’s going to take some time to get there. In future years, they may want to set up recurring contributions of $200 each per month, but for now, that money should go into Mike’s 401(k).

Increase Mike’s 401(k) contributions

I’m going to tell it to you straight, Mike: you need to save more in a tax-advantaged retirement account. If you want to stop working at some point and not have to dramatically change your lifestyle for the worse, you’ve got to get those retirement savings up. At this current rate, most of your income post-retirement will have to come from government benefits like social security. With rising living costs, living comfortably4 off social security benefits is nearly impossible in most metropolitan areas. Beverly has the benefit of a generous company match, but you don’t—so unfortunately, it’s all on you.

You’re going to more than double your 401(k) contributions. I want you to save 20% of your gross income in your 401(k). That’s a 12% increase. I want you to put $15,000 of contributions into that 401(k) in 2025.It’s going to hurt, and your paycheck is going to shrink, but you’re going to try it. If you can’t do it, dial it back, but I want you to push yourself. Currently, you’re saving 8% of your gross income. Reach out to your 401(k) provider and change it to 20%.

Increase Beverly’s savings

Beverly, you’re already a great saver. You told me you’re contributing $100 per paycheck to a savings account. How would you feel about bumping that to $150 per paycheck? Could I push you to $200? Just a small move in the right direction.

Instead of putting that money into cash, consider putting it into a taxable brokerage account. This gives you more optionality. You could also increase your 401(k) contribution if you wanted, but I think automatic savings to a brokerage account would be more fun for you.Who knows? Maybe this becomes the seed money for a down payment on a little cabin. Or, if kids are potentially in the picture, I’d love to see you put that money into a 529 College Savings Plan—you’d get a nice little tax deduction in New York State for that too.

What can we learn from Beverly and Mike?

A company 401(k) match is powerful fuel on the fire for retirement savings. Even when your salary isn’t enormous, that match makes a huge difference. Remember: money in 401(k)s and IRAs is protected from taxes every year as it grows. So as you earn dividends and interest on the stocks and bonds in your account, you DON’T PAY TAX ON THEM. This is true of both Roth and Traditional accounts.

Compound interest is so awesome. Look at Beverly’s 401(k) balances—she’s got almost $130,000 in there, which is more than her salary. Diligent contributions plus the power of the stock market are a delicious combination.

Not having access to a 401(k) because your company doesn’t offer one is a bummer. If that’s your situation, you’ve got to get yourself into an IRA. Traditional or Roth, I don’t care. At the end of the day, it doesn’t really matter And let me tell you, the debate over Roth vs. Traditional IRAs is just a bunch of hand-wringing—just get the money in there.

If your parents can spare it, ask them to help fund your IRA. Having both an employer 401(k) and a personal Roth IRA is a great way to diversify the tax treatment of your savings.

If you think you’re not saving enough, your instincts are probably right. Don’t sit around like a turtle on its back. Make a change. Don’t make excuses. Sure, going to a financial planner will probably help a lot, but you can easily take the first step: increase your 401(k) contribution at work by 2% this year—or even 5% if you’re feeling spicy. Don’t have a 401(k)? Open an IRA and contribute to it. (Pro tip: If you make less than the income limits, go Roth. If you’re over the limits, go Traditional.)

Wrapping It Up

Money is messy. Marriage is messy. Money in marriage? That’s boss level. But Beverly and Mike are doing a lot right. They’re asking smart questions, living within their means, and figuring out how to plan for the future as a team.

My advice? Start saving together, automate what you can, and don’t get too bogged down in the numbers.

Parting shot: When it comes to changing savings behaviors, it’s not about perfection; it’s about progress.

The best $20 bucks I spent this week: Onxy Storm, the third book in the sexy dragon rider series by Rebecca Yarros.

Theodore Roosevelt said that.

This isn’t a perfect or complete balance sheet. There’s a student loan that should be on there but we didn’t get the details.

Or even being able to afford basics like food and shelter.

I enjoyed this piece. I would add that we don’t actually know if they are living below their means and where the money will come from to increase their savings and investing. I think having a total picture of spending (including essentials like groceries) would help you to provide the best advice possible.

Excited to see where you go with this!

I love this concept! Love and money are so hard and so awkward. I'm excited to follow along in the next series of posts!